Some of the links in this post are affiliate links. This means if you click on the link and purchase the item, I will receive an affiliate commission at no extra cost to you. All opinions remain my own.

I used to think that once you created a budget, life was just peachy. That there was nothing more that you needed to do to reach your financial goals or save hundreds or thousands of dollars. It was all smooth sailing from there on out. Or was it?

Maybe you’re new to the world of budgeting or you’re just starting out with a new and motivated round of intention of actually following through on your budget this time around.

Grab a pen and paper, you’ll want to take notes!

Here are some of the most profound budgeting tips for beginners that will help you prevent the roadblocks along the way and help you find your discipline and motivation. You’ll be budgeting like a pro in no time and creating wealth or paying off debt.

Why do people fail at budgeting?

If budgeting is so important for your finances, then why do so many people fail at it? There are many reasons why people aren’t able to keep a budget.

Often, one of the biggest reasons that people quit is just that they give up too soon. They don’t give it enough time or potential for a habit to build. Results don’t happen overnight, and you need to adjust to this new way of living. Give yourself grace for when it gets tough and you slip with your budget. It’s okay, just move forward.

Another major reason is that they don’t have a reason to budget to begin with. They don’t define their “why” and soon lose steam once the initial excitement or momentum has worn off.

Common Budgeting Mistakes

The best way to avoid budget failures is to learn what the most common mistakes actually are. At least then you have a more accurate picture of what you’re up against when you start this budgeting adventure.

Some of the most common budgeting mistakes include:

- Not creating realistic budgets or goals

- Not reviewing your budget at the end of the month

- Forgetting expenses you should have caught

- Giving up too soon

- Not making room for fun or splurges

- Not writing it down somewhere

Budgeting can be tough when you’re starting out. It’s best to set yourself up in the best way you can by learning and acknowledging the most common mistakes. Learning how to avoid these is a game-changer budgeting tip.

How To Start Budgeting: Best Budgeting Tips for Beginners

I think it’s easy for most of us to start something new. It’s exciting and shiny and offers a lot of upfront possibility or potential. But the reality is that following through on that something is not always easy. It takes discipline.

What has helped in my life the most is having an idea of why I do something. What is the underlying reason why I want to start adding a habit or discipline to my life? If I want to get fit, I would add working out to my daily schedule. If I wanted to write a book, I’d add time to write every day to my to-do list.

Once you have a why that’s driving the action, it might not make the follow through any easier, but it does give you the reminder that it’s going to be worth it in the end.

Once you have a why that’s driving the action, it might not make the follow through any easier, but it does give you the reminder that it’s going to be worth it in the end. Click To Tweet

So what is your why when it comes to wanting to start and stick with a budget? Some examples that you might want to consider and use as your own personal why include the following:

- You’re tired of carrying debt

- You’re tired of being BROKE

- You want to have more money

- You want to become more financially responsible

- You want to be successful or financially secure by a certain age

There’s no perfect reason why you should start a budget. Everyone is motivated by something different. The one thing that matters is you find something that makes you tick and continues to drive you forward.

1. Write Down Your Financial Goals

Similar to your why for budgeting, you should also have your financial bucket list. What are your short and long term goals financially?

In my own life I’ve struggled with student loan debt, credit card debt and not creating the discipline of saving every month. I lived paycheck to paycheck for so long that I started to believe that somehow it was normal.

Creating a budget was the only way that I knew how to get my life back under control when the chaos of everything around me was too much to get a hold of. Maybe you feel like that?

Or maybe you’re saving up for your first house? Or want to increase your net worth by a certain amount. Maybe you want to save up for an exotic vacation to an island that you’ve been dreaming about your whole life. I think it’s super important to have different types of financial goals on your journey. Some of these financial goal categories include:

- Debt payoff

- Savings builder

- Net Worth Increase

- Saving for retirement

- Saving for a home or other large purchases

- Finding financial freedom

This isn’t an extensive list, but I 100% think it’s important to have an idea of what you want out of this. If you know what you want to achieve, you can do far more than what you might realize. If you have a why, you can sustain yourself during all of the doubt and times where you want to give up.

Because, with budgeting money, there will be times you’ll want to give up. So think about your goals and write them down somewhere.

2. Select your budgeting method

I think it’s important to note that not everything that works for me will work for you. I’ll just get that truth out there quickly so that there’s no confusion.

We all work best in our own ways. And I truly believe our personalities and dispositions lead us to needing different structure to accomplish the same thing. The budget that might work for me might make you want to pull your hair out every month. And if it’s causing that kind of reaction, I guarantee you have the wrong budget selected for yourself.

Don’t fall into the trap that everybody’s road to success with finances must be yours as well. It’s just not true. And you’ll burn out faster than you can say “my finances are screwed.”

Make sure you test different types of budgets. Familiarize with what kinds are out there and try different ones. See which ones work best for you or your family. Maybe you like to manually track yours, maybe you’d rather have all of that work done for you. Fine and fine.

You can choose to keep a simple excel spreadsheet or you can choose budgeting software like YNAB or Mint.com. There are so many digital solutions to problems we face nowadays, so let’s use them!

3. Revisit your budget monthly

Not a set it and forget it type of process. If you treat it this way, you’re setting yourself up for failure.

When you write up your budget, it’s all based on estimates (and some close #’s like CC bills, utility bills, rent etc.) but this doesn’t mean everything is going to run smoothly. Not a perfect world.

“Revisit your budget on a monthly basis. You don’t have to give it a thorough overhaul – just devote a few minutes to adjusting for an extra windfall, new commissions, fluctuating utility bills, or anything else you didn’t plan for in the month prior.”

4. Start with the most important categories first

Expenses like rent, transportation, food, utilities, insurance, medical, etc. These are what you call the basics.

Sometimes don’t know where to start when creating budget but it’s best to start with the expenses you do know that are going to be essentials and will pop up every month. Once you have this out of the way, you’ll know what you have to work with for all non-essential costs.

5. Incorporate Sinking Funds

You’ve probably heard of an emergency fund, but you’re likely reading this tip and wondering what in the world a sinking fund is and how it relates to budgeting.

Sinking funds are funds set aside in specific savings accounts for known expenses that happen infrequently throughout the year. This is in stark contrast to the emergency fund savings that are put into savings but are for unknown expenses that occur. Examples include:

- Christmas/holiday spending

- Vacations

- Utilities that fluctuate throughout the year

- Gifts

- Car repairs

Learning and implementing sinking funds is crucial to budgeting successfully and warding off storms. Don’t go over-budget for an area that you could have built up cushion for earlier.

6. Come Up With A Zero-Based Budget

The zero based budget sounds complicated, or at least you might not understand what it means from the name, but the idea behind it is simple.

Make every dollar that you earn or receive work for you.

Give every dollar a purpose or a job. Assign it to a category, even if that category is “saving.” Every dollar needs a home.

Go put this into action now! When setting up your budget, if you have $4,000 coming in every month, make sure that you’ve created a specific category whether it’s an expense or savings line item for every single one of those dollars.

If you try the zero based budget, you will know where all of your money is going. Not just parts of it or the parts that you are aware of. Don’t you want control of your money or do you want it to control you? This is a crucial step for beginner budgets to prevent losing control of their money.

7. Track your progress

Your budget won’t really be helpful if you don’t actually keep track of what you’re spending. I can make a budget for what I plan to spend on food but that doesn’t mean I spend that amount.

It’s important that you find a method that works for you to keep track of your daily spending. This includes all spending whether it’s via your debit card, credit card or cash. (Pro-tip: don’t forget to add tracking cash purchases).

This is one of the most overlooked budgeting tips for beginners. You can’t look at your budget from the lens of reality if you don’t have the “actual” numbers in front of you.

Once I skip a day or a few days for where I’m spending money, it all feels like a downhill slope. This slip consistently messes up my budgeting system. I’ll start with 5-10 days behind and then have absolutely no motivation to catch up. Before I know it, I’m telling myself I’ll try the whole budgeting thing again next month. But we all know what that really means.

Find a time to input your expenses (if you’re doing so manually) during the day and stick to that time schedule.

If you find that it’s easier to have this done automatically, check out a software like YNAB, Personal Capital or Mint.com. You won’t need to manually track expenses throughout the month like you might with a spreadsheet. It’s usually a lot easier to use an automated software when you start budgeting and then switch over to a manual process later. And some people just absolutely hate manual processes.

8. Separate Wants vs Needs In Your Budget

Needs are expenses that you’ll need to pay in order to live or survive. This will include rent, food, transportation costs, and other medical type costs. Anything you can’t skip over.

Wants are expenses that you can’t classify as needs in your everyday life. They are the “nice-to-have’s.” This can include eating out, your clothing budget, vacations, and more. If you can live without it, it’s probably not a need.

Learning how to figure out the difference between wants and needs and distinguish those differences is key to having a successful budget. It’s also a key learning point on the budgeting tips for beginners list.

9. Change your Money Mindset

A money mindset is the overriding thought process that you have about your finances. The way you define your relationship with money view your finances will have a direct impact on every financial decision you make.

Changing your mindset might seem like some type of new-age marketing scheme, but it’s not! Practicing a positive mindset towards your finances will help you to make better financial decisions and to create the financial freedom you’re after.

There are loads of books that discuss the scarcity versus abundance mindset towards money. It’s crucial that you learn the differences and figure out which bucket you’re in. Learn to accept your starting point and how to build your future with this new mindset and this will change everything.

10. Emergency fund

An emergency fund is crucial to setting yourself up for any bizarre or unknown expenses that hit when you least expect them. Car problems might require a visit to the mechanic with a hefty bill. Lose your job? You’ll be stuck paying rent without an income.

It’s recommended that you save at least 3-6 months of your living expenses upfront within an emergency fund. This number of months will be your goal, but you can contribute small amounts every month until you’ve hit that goal. Remember, that $100 can actually go a long way if you’re consistently saving.

11. Use cash for budget categories that trip you up

Everyone has a problem area where they find themselves spending far more than they’d like to if unchecked. A great way to add a natural check to the budgeted amount you’ve set for a category is to switch that category over to a cash only payment option.

Using cash only for a specific expense category can help to curb your spending. You’ll realize that you only have a set amount, and once that hits, you’re cut off. Example problem areas (for me!) include the following:

- Groceries

- Eating out

- Clothing

- Entertainment

What are yours?

12. Automate Your Savings Plan

If you want to make sure that you’re saving every single month, take the manual decision process out. Find a way to set up your savings plan to be automated every single month so you can truly set and forget, unlike other areas in your budget.

You can use apps like Digit or Qapital for the ease of using something directly connected with your phone to save more money.

Other ways to save more automatically would be to contribute more to your retirement plan with your employer or have your paycheck split between your savings account and checkings upfront.

13. Outline Your Savings Goals

Similar to writing down your financial goals you want to accomplish from budgeting, you should also write down your savings goals as well. These two goals can be written down in the same sitting as they often overlap. Even so, it’s important to have savings goals along with your other financial goals.

Your savings goals might be: saving up for a down payment, a vacation or even starting your emergency fund. It depends on where you are in your financial journey but savings are crucial to your budget.

Budgeting tip for inconsistent income

It’s still possible to feel financially secure without having a consistent, known value income every single month. Many entrepreneurs deal with this inconsistency, so it’s a well-known variable that can be molded to fit within a budget.

Figure out your “bare minimum” number needed for a basic month of living (i.e. rent, immediate expenses, financial goals etc.)

Use this bare minimum number to subtract from last month’s salary to figure out how much you have to work with for other types of non-essential spending

Start with your lowest monthly income budget estimate. Budgeting for the absolute smallest amount possible helps you understand how to budget at the lowest possible amount. If that number increases it’s much easier to work with that then the other way around. Check out your income for the last 12 months and find the lowest number and start there. How can you make this amount work?

Make adjustments to your budget! If your income is higher than what you estimate, be sure to adjust for this during the month and allocate those dollars out to a home.

How to budget money

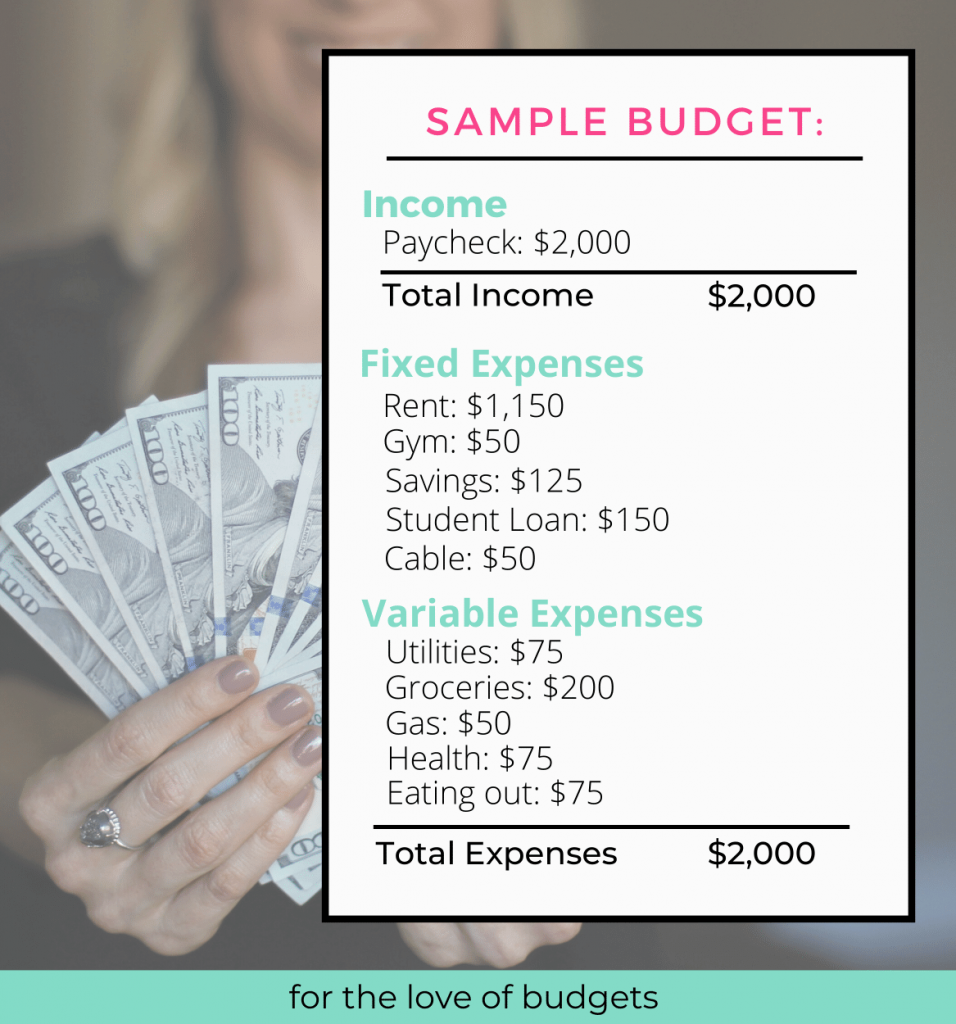

Components of a personal budget

A budget itself isn’t as complicated as some might feel. There are a few key components to a budget that you will need to understand and use for making your budget work. Budgeting tips for beginners should start with understanding what a budget is made up of.

- Income – all inflow of cash that you receive, whether it’s salary or other source(s).

- Expenses – outflows of cash that you spend your income on monthly.

- Variable expenses – expenses that vary depending on season or month along with amount.

- Fixed Expenses – expenses that remain consistent and don’t vary in amount or season. AKA you can count on these to happen.

- Budget categories – buckets that you give different expenses or incomes to make sure all dollars are captured in your budget period.

Other key components to budgeting include learning how to track your expenses throughout the month as well as reviewing your results. Figuring out what went well and what didn’t will be crucial to understanding and getting better at budgeting as a beginner.

Budgeting categories

Budgeting categories keep track of your monthly expenses and show you what your money goes towards. It’s important to have recommended budget categories in your budget as it will give you a starting point. You won’t miss any important expenses that will hit you within the month.

Some of the most common categories for budgeting beginners include the following:

- Housing

- Transportation

- Food

- Utilities

- Clothing

- Medical/Healthcare

- Insurance

- Household Items

What is an example of a budget?

If you’re interested in seeing all of these different pieces fit together, check out this super basic budget example. Use it as reference if you want to set up your own.

How can I get better at budgeting?

You might find that budgeting as a beginner might not come naturally to you. That’s okay! It’s a skill that’s learned and practiced like any other. If you’re looking for ways to become better at budgeting here are a few key notes you might want to consider.

Find accountability. It’s not easy to go it alone. Find a friend or family member that can encourage and/or begin to budget with you.

Find what system(s) or tools work the best for you, not for other people. Don’t fall into the trap that you have to budget the way that works for others. It’s no use forcing something that doesn’t fit. Base it off of your lifestyle and what you need. Rinse and repeat till you find something that works.

Practice consistency even when it gets tough or doesn’t feel natural. Habits take time to form, and things we’ve never done always feel awkward or uncomfortable upfront. Learn how to persevere even if it doesn’t feel right or normal for you.

Try an online budget tool

If you need some help or need structure when it comes to budgeting, it might be a great idea to try out an online or software based budget. These tools make budgeting a lot easier and more automated. Don’t keep trying the manual approach if it’s not working.

You’ll also find that these tools can be used on the go whereas sometimes pen & paper or spreadsheets might not be the answer if you’re looking for portable options.

One of my favorite budgeting tools happens to be YNAB (you need a budget) that helps you budget to get a month ahead of expenses. If you’re looking for a spot where you can track expenses and inflows all in one place, Personal Capital takes the cake for me. Others prefer Mint, EveryDollar, and others.

While it might seem daunting at first, you shouldn’t assume that just because you’re a newbie to the world of budgeting it won’t work. Or that, if you don’t know what something is or every detail about it upfront that it won’t work. You should also note that not being good at something isn’t a reason to not do something.

These budgeting tips for beginners help you target ways that you can ease yourself into budgeting and take out the stress or surprises before they arrive.

If you’re a new budgeter over here, tell me a great tip either from this article or from elsewhere that you’ve learned that has really sky-rocketed your budgeting skills?